Nelson Center for Entrepreneurship

Nelson Center for Entrepreneurship

Applications Now Open for B-Lab & BVP 2026

Take your venture from idea to impact! Join B-Lab, Brown’s transformative summer accelerator, or pitch on the big stage at Brown Venture Prize, our headline venture competition. Apply by January 30, 2026 at 1pm EST.

Stay in the Loop!

Get the latest on events, startups, and opportunities at the Nelson Center.

See, Solve, Scale

Brown is fertile ground for entrepreneurship — for students, faculty, and alumni alike. We believe entrepreneurship is a powerful way to solve problems and spark change. Our courses, programs, and venture support help students turn ideas into lasting impact.

Where Do I Start?

Not sure where to begin your entrepreneurial journey? Explore our programs, connect with mentors, or attend an event - we're here to help you take the first step.

Creating Solutions with Impact

At the Nelson Center for Entrepreneurship, we empower a vibrant community to turn ambition into ideas into tangible ventures, driving real-world change. Our commitment to fostering entrepreneurship is reflected in the cumulative achievements of our ecosystem.

Omena

Founded by Francesca Raoelison ‘23, Omena equips young people with Social Emotional Learning (SEL) tools to break trauma cycles and build resilience, transforming education and advocacy in Madagascar and beyond.

Perennial

Founded by Jack Roswell ‘20, Alex Zhuk ‘20 and David Schurman ‘20, Perennial leverages digital soil mapping technology to enable cost-effective, precise measurement and verification of sustainable agricultural practices, supporting scalable global climate action projects.

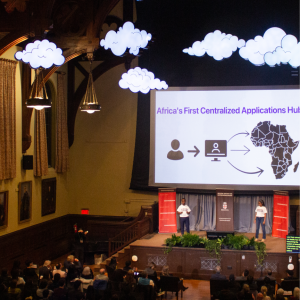

We do "hubs" really well. Our Nelson Center for Entrepreneurship is fast becoming one of the most impactful hubs on campus. There, students hatch ideas, launch ventures, and hone entrepreneurial skills — not just in business, but in how business can transform lives.